Page 3 - Leumi-ABL-Deals-Review-2015

P. 3

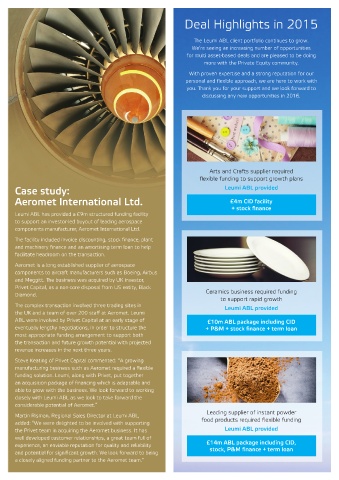

Deal Highlights in 2015

The Leumi ABL client portfolio continues to grow.

We’re seeing an increasing number of opportunities

for multi asset-based deals and are pleased to be doing

more with the Private Equity community.

With proven expertise and a strong reputation for our

personal and flexible approach, we are here to work with

you. Thank you for your support and we look forward to

discussing any new opportunities in 2016.

Arts and Crafts supplier required

flexible funding to support growth plans

Case study: Leumi ABL provided

Aeromet International Ltd. £4m CID facility

+ stock finance

Leumi ABL has provided a £9m structured funding facility

to support an investor-led buyout of leading aerospace

components manufacturer, Aeromet International Ltd.

The facility included invoice discounting, stock finance, plant

and machinery finance and an amortising term loan to help

facilitate headroom on the transaction.

Aeromet is a long established supplier of aerospace

components to aircraft manufacturers such as Boeing, Airbus

and Meggitt. The business was acquired by UK investor,

Privet Capital, as a non-core disposal from US entity, Black

Diamond. Ceramics business required funding

to support rapid growth

The complex transaction involved three trading sites in

Leumi ABL provided

the UK and a team of over 200 staff at Aeromet. Leumi

ABL were involved by Privet Capital at an early stage of £10m ABL package including CID

eventually lengthy negotiations, in order to structure the + P&M + stock finance + term loan

most appropriate funding arrangement to support both

the transaction and future growth potential with projected

revenue increases in the next three years.

Steve Keating of Privet Capital commented: “A growing

manufacturing business such as Aeromet required a flexible

funding solution. Leumi, along with Privet, put together

an acquisition package of financing which is adaptable and

able to grow with the business. We look forward to working

closely with Leumi ABL as we look to take forward the

considerable potential of Aeromet.”

Leading supplier of instant powder

Martin Risman, Regional Sales Director at Leumi ABL,

added: “We were delighted to be involved with supporting food products required flexible funding

the Privet team in acquiring the Aeromet business. It has Leumi ABL provided

well developed customer relationships, a great team full of

experience, an enviable reputation for quality and reliability £14m ABL package including CID,

stock, P&M finance + term loan

and potential for significant growth. We look forward to being

a closely aligned funding partner to the Aeromet team.”